A financial bubble by definition is the unsustainable growth of a market due to deviations from certain market fundamentals. These bubbles, much like the ones your 5-yr old blows out in the backyard, will pop. That’s just the nature of the beast. Today we will examine several major contributing factors to the expansion of the recent US housing bubble. It’s unlikely any single factor could have fueled such a massive bubble, but the combination of such factors clearly illustrate that it is more than just the sum of its parts.

A) Lax Lending Standards

What lending standards? Oh, that’s right – I almost forgot about that part of the equation. During the past few years everyone and anyone could get a loan for a house. Even if you had a bad credit score, no down payment, no assets, credit card debts, low/non-documented income or a combination of any of the above, you could apply and be approved for a home loan in a snap.

A person’s credit score is a measurement of his or her financial responsibility. Albeit not a perfect system, it’s the system we have to work with. It does not take a rocket scientist to figure out that lending big wads of cash to financially reckless people is a huge risk. The lax lending standards dictated by the mortgage industry flooded the market with a huge (and new) sector of buyers – under qualified buyers. A person with a 590 credit score and $17,000 in credit card debts at 18% interest has no business in applying for any loan, let alone a large loan for a house. The Feds added fuel to flame when it tolerated this and quietly swept the issue under the carpet as their Wall Street cronies enjoyed the bull run.

An abnormally large influx of first time buyers created an opportunity for the market to expand and grow at an abnormally fast pace. Now that investors realize that these people cannot make their payments, as evident in widespread foreclosures across the nation, lending standards will tighten and rid the market of this buyer group. Reducing the buyer pool certainly tips the scales of supply and demand.

B) Innovative Loans

As an engineer and US patent holder, I revel at innovation. It stems from creativity and marks a new age in the way we live. Unfortunately for us, the innovative loans developed in the past few years only served to prop up over-valued properties and the paychecks of fraudulent brokers, real estate agents and lenders.

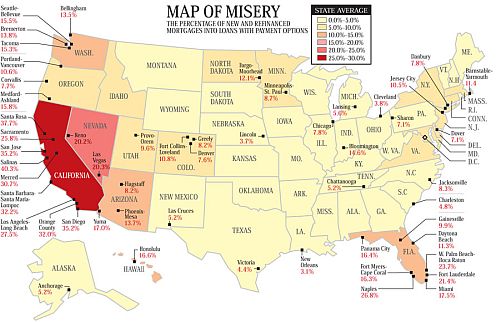

Adjustable rate mortgages are not new to the market. They’ve been around and used for years, but not to the extent that it was during this rally. About a third of all new or refinanced loans made in California during the last few years have some form of payment options. That’s astounding.

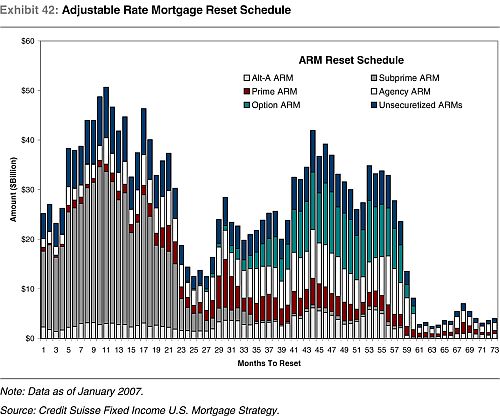

Since the vast majority of the general population cannot buy homes with cash, the purchasing power of the buyer is limited by the amount of money he can borrow. Low teaser rates loans at 1%-4% allowed buyers “buy” more home than they can afford because they are borrowing money at an artificially low interest rate for the first couple of years. This fueled a silly bidding frenzy as people can borrow more money than normal for a relatively low monthly payment until the loan resets. This is not just a subprime problem; there are plenty of Atl-A and prime ARMs as well.

The IO, or interest only, loans are self explanatory. Making payments on the interest only does nothing to reduce the principle amount borrowed. The delusional buyer is really just renting from the bank. So instead of renting a residence, the buyer has to pay HOA fees and be responsible for any maintenance work as well.

Another horrendous option loan is the negative amortization loan. In a traditional amortized mortgage, you’re paying a large percentage of interest to the lender, but still making a dent in the principle amount over the course of the loan. With neg-am loans, you actually owe the bank more money than you original loan amount because the monthly payment doesn’t even cover the interest on the loan! So the remaining amount gets added to the principle and the borrower owes more and more money each month. It’s like not paying off your credit card payments in full every month, but on a much bigger scale.

C) The Growth of the Secondary Mortgage Market

The above-mentioned loans only exist because there’s a market for it. Most banks don’t hold the mortgage in their portfolio, but turn their profit through fees and points and just sell the loan to another lender. Even with lax lending standards, the banks and their stockholders are only willing to risk so much. But the home prices keep increasing so what do they do? Welcome the birth of the second mortgage.

The conforming loan amount is $417,000. A borrower who needs a bigger loan is slapped with a higher interest rate because they represent a higher risk investment. To combat that, buyers turn to a different lender for the portion of the loan over $417k to keep the interest rate down. This too pushed home prices up because it gave buyers more borrowing/buying power than risk-adverse investors are willing to tolerate. The NAR is pushing for the Feds to increase the conforming loan amount. I am against that because it does nothing to fix the affordability problem we’re facing right now.

There’s a good reason why proven fundamentals exist to keep things in check. Unjustifiable risky investments are bad investments. When the market starts to deviate from market fundamentals, trouble brews and stupidity ensues.

D) No Down Payment, No Problem

Zero down loans is the crux of it all. A 20% down payment used to be the admission ticket to home ownership. It proved the borrower is financially responsible and prudent. It also gives confidence that they are willing and capable of making the mortgage payments.

With no money down, there is zero risk to the buyer because he has no stake in any of it. This is every flipper, speculator and shady investor’s wet dream. They can “buy” a house with hopes of double-digit appreciation without any risk whatsoever. If the market tanks like its happening now, they simply return the keys and walk away with nothing more than a dinged credit score. The lender is left holding the bag with an asset worth less than what they paid.

These were the big players that caused the rally in home prices and it will be the removal of these same factors that will result in the collapse of housing market. There are no more liar loans, secondary mortgage markets nor zero down home purchases. When it’s all said and done, the banks left standing will revert back to what they know works and that is verified, documented income with 20% downpayment required.

Приветствую всех!

У меня такой вопрос,кто что интересное подскажет буду признателен.

Мы с друзьями собираемся поехать в круиз по просторам России и ближнего зарубежья месяца на два на своих машинах,но не как не можем согласовать маршрут,если у кого уже был опыт такого путешествия,может,что посоветуете.Девчонок с собой не берем,думаем,что во все городах России с этим не будет проблем,если у кого будут рекомендации и в вопросе отдыха с девушками тоже буду признателен.

С уважением Сеньчик

My wife and I lost a house to the California crash of 1991. The cause appeared to be manipulated interest rates and a flood of money being injected into the economy during the Reagan administration. When Bush #1 took office he had a budget problem and cut back government spending. It took 2 to 3 years for inventory to pile up and cause prices to come down. The recession was horrible. I remember being in the coin/ antique business and watching prices come down and finally bottom about 1995. That was six years of bad economy to flush out all the easy money and start stable growth again. We have a long way to go, brace yourself.