Two days ago I profiled a decent property on Oxford Drive that was overpriced by $200k. Today we have a home on the same street. It lacks the charm and desirability but asking for over $500 per square feet.

481 Oxford Dr.

Arcadia, CA 91007

Price: $850,000 ($502 per sq. ft.)

- Beds: 3

- Baths: 2

- Sq. Ft.: 1,692

- Lot: 0.32 Acres

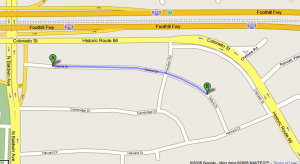

This property is literally 1 block West of Tuesday’s profile:

From the photos, it looks old, cheaply remodeled and lacking any desirable landscaping for its third-acre lot. This is a knife catcher hoping to find another knife catcher. The seller purchased this home for $680,000 four months ago. At $402/sf, it was overpriced to begin with. Do you think the “newly remodeled” 481 Oxford is now worth $502/sf after four months?

So what should we value this property?

$350/sf – $592,200

$300/sf – $507,600

Oh yea, did I mention this was located right next to the 210fwy?

$680k in remaining 2008 selling season if another smart knife catcher comes along.

$592k in 2009.

$500k in 2010.

$450k in 2011.

Little harsh on the remodeled comments. Does not look too bad to me. Price is still too high being so close to the FWY.

It was pretty harsh, but from the photos I would expect a lot more to be done to justify the $200k premium on top of an already overpriced home.

I think you would agree that $100-200k could give any home a major face lift.

This is the list when the property was on market last time. You may compare what the new owner did to the property. Actually, I went to see the property several times. It’s very very old and bad maintained. Though the street is quiet and nice, it’s noisy in the backyard.

http://www.ziprealty.com/buy_a_home/logged_in/search/my_home_detail.jsp?property_type=SFR&source=MRMLS&cKey=6l3sj637&listing_num=W07169031&mls=mls_so_cal

I wonder if this was a purchase four months ago by a die hard flipper from the Great Housing Bubble era?

He has probably spent $40-$50k to improve the kitchen, bath rooms and floor. He has to budget at least $40-$50k for round trip transaction costs. Let’s use $90k in total as assumption. This adds up to $770k total cost. So he is asking about 10% for his effort which seems reasonable in a normal market condition.

He would have put it up for $1.2 million back in 2006, and, somebody would have bid up to $1.3 million for god’s sake with 100% financing.

However, the market is in a free fall. Odds are this flipper is going to flop on this property. Another “smart” flipper is just non-existent. How much he will lose depends on if he recognizes what really is going on.

By the way, the owner occupant rental equivalent on this is about $2500 monthly rent @ GRM160 – $400k. One could argue that the Arcadia super school district demand GRM 0f 200. Well, it is then $500k.

YuLu,

Where is the backyard noise coming from?

Love your new series of freeway homes. You are doing a great job with these!

the lovely freeway traffic, of course.

Irina,

Thanks for the support. SavedbyGrace has received your email. She’s been busy but plans to get back to you soon.