There is a popular saying among wannabe real estate gurus,

There is nothing you can buy in desirable Los Angeles cities that will cashflow.

Maybe they are right. Maybe they are wrong? How low will this property have to drop in order to align itself with comparable rental rates?

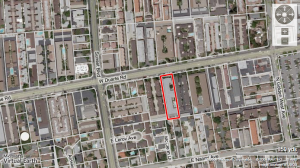

1022 W Duarte Rd #13

Arcadia, CA 91007

Price: $415,000 ($315/sf)

- Beds: 3

- Baths: 1.75

- Sq. Ft.: 1,316

- Property Type: Attached, Townhouse

- Year Built: 1971

This is an old property located on a section of Duarte Rd. that’s home to rows and rows of similar type town homes and apartments.

At $415,000, this townhome will require a 20% down payment of $83,000 and a True Cost of Home Ownership (TCHO) of $2,500 per month. But wait! There’s a $205/month HOA fee; bringing your final total to $2,705/month.

What would it cost to rent an equivalent home or apartment?

$2200 / 3br

$1495 / 3br

$1980 / 3br

$2300 / 3br – Single family home

$1725 / 3br – Single family home

Would you spend $83,000 in addition to $2,705/month to own this place? At least the rooms comes painted!

Assuming this unit can rent for $2000/month, GRM160 makes it $320k for an owner occupant. It will be lower to, perhaps, $240k (GRM120)for an investor to be interested in this though, since no appreciation potential in the next few years.

george8,

This property actually sold for $220 just 6 years ago. So based on your analysis, $240-320k seems like a reasonable range for this townhome.

Straight line appreciation from 2002 gives us these values:

3% $262,691 ($199/sf)

4% $278,370 ($211/sf)

5% $294,821 ($224/sf)

6% $312,074 ($237/sf)

Currently listing for $415,000 ($315/sf). LAUGHABLE.

My two cents…..

This place is worth between $200 and $250k… Because even the $220k price is in the bubble run up, and no one in their right mind would dump $80k, and pay that note a month for this dump.

We’ve kept an eye on the rental market for nice 2 BR apts/condos in the Arc/TC area for my in-laws. Some rents for 2 and 3 BR houses on Craiglist are getting attractive. However, I’m concerned about “owners” simply pocketing the rent/security deposit, etc. and until the property is foreclosed.

Does anyone know if this is a growing problem for renters in this area, and are there ways to protect against this without resorting to suing the owner later for unreturned deposits?

Very good point. Some renters buy their property through state / city sponsorered first time home buyers program which restricts them from renting. If caught, you will have to move out immediately.