Zip Codes: 91006, 91007![]()

Current Market Listings as of March 15, 2008

Properties for Sale: 257 (+57)*

Median Listing Price: $769,000 (+1.4%)*

Weekly Foreclosure Update*

Properties in Foreclosure: 15 (+1)

Properties in Pre-Foreclosure: 72 (+8)

*+/- is compared to previous week’s data.

Although there is no shortage of data and reports showing that Souther California’s median home prices have dropped at record rates, there will still be the occasional piece proclaiming a strong market in desirable cities. Thanks to our AHB reader, Beachy, I was pointed to an article on the L.A. Land blog stating just that: A tale of two markets: High end holding steady. Peter Vile’s writes an excellent blog and I’m not trying to challenge his data (it’s the same numbers I use).

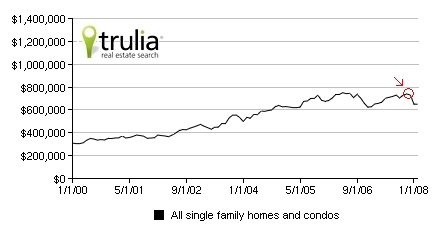

Peter reports that Arcadia’s median sales price is up from last year and my weekly Trulia chart also reflects this:

Median Sales Price for Homes in Arcadia

He then poses a question that I’m sure all of us have contemplated:

Will prices inevitably fall in the higher-priced areas, or will they hold their value? The short answer is, I don’t know. My gut is that prices will eventually decline in pricier neighborhoods, but won’t fall anywhere near as far as they will in cheaper areas. But I haven’t seen this movie before.

A very respectable answer to his own question. I, on the other hand, am willing to reach out there and say yes; even homes on the higher end of the spectrum will face declines comparable to their sub-$500k neighbors (percentage-wise).

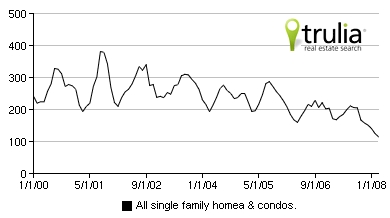

Drawing from the same data used in the above chart, we can see that the volume of home sales have dropped off significantly since 2007:

Number of Home Sales in Arcadia, CA

I have always maintained that a decrease in transactions and increase of inventory will precede any major drop in sales prices. Sacramento, San Diego, the Inland Empire and even Orange County have all gone through this in the last 12 months.

Will Arcadia be any different? We have experienced incredible double-digit appreciation numbers over the last 3 years. I don’t find it hard to believe that a national real estate, credit and economy crisis will reverse those gains.

Property and foreclosure numbers obtained from U.S. Census, ZipRealty, Trulia, Yahoo Real Estate and Foreclosure.com. Market listings obtained from DataQuick News.

Excellent info and analysis SBG.

Up until this evening, I felt like I was in the “cat bird seat” renting & waiting for housing’s ultimate demise. Now I just hope that in the morning, given the Nikkei’s crash and Bernanke printing money out of thin air to fund Bear Stearns – my dollars are going to be worth anything.

All those Wall Street scums deserve every moment of it.

However, we are all going to be impacted by this.

Can you imagine practically every domestic mutual funds has BSC in the portfolio?

No doubt that everyone will feel poorer regardless

Props go to TheArcadian for the weekly inventory and market reports 🙂

I agree there’s no round about way to this and we’ll all be affected. It’s ugly now, but I can’t bear to think how much nastier it’ll be later this year. Brace yourselves folks, we’re in it for a rough one.

The market is already pointing sharply lower this morning after the Asia market plunge overnight.

Rumor has it that Lehman Bros and WAMU might be next.

Oops – yes – props to TA! 🙂

llking,

WAMU had dipped heavily into the subprime arena without regard to the risk they were undertaking. It would not surprise me if those rumours turned out to be true.

I read an article this morning where some Wall Street analyst blamed the housing market and economy for the downfall of BSC, WAMU, LB, ect. As you can imagine, I found this ridiculous because it was WALL STREET that got us into this mess.

🙂