Yesterday, we wrote about how foreclosures will lead this housing correction and the reported numbers are breaking all sorts of records:

California – 1st quarter 2008

- 113,676 Notice of Defaults issued – Up 39.4% from the previous quarter.

- Notice of Defaults are up 143.1% from first quarter 2007.

- Actual foreclosures totaled 47,171 – Highest since DataQuick started tracking in 1988 (20 years ago).

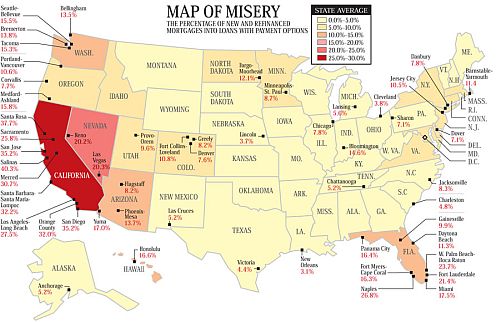

According to DataQuick, the increase in foreclosures can be contributed to a significant drop in property values and the wave of exotic mortgage made in 2005-2006. Remember the Map of Misery? It gives you an idea of where the largest numbers of exotic mortgages are concentrated in.

These red states experienced incredible price appreciation leading up to the peak of the housing bubble. As reflected on the map below, they are now experiencing the brunt of decline.

Although we sounded crazy predicting a long and hard housing crisis, it looks like Wall Street is starting to reach the same conclusion that many housing blogs came to last year. According to a Goldman Sachs analyst, “the correction in national house prices is only halfway through” and,

Arizona, Florida, Virginia, Maryland, California and New Jersey, could see further price declines of 25% or more.

God I hope so, then i could actually buy a house withough working two jobs.

With the Fed cutting interest rates since August 2007 the side effect is the devaluation of the dollar. Crude oil is traded with dollars and it hit about $126 a barrel yesterday. Most other countries have not cut their interest rates and their currencies are proportionately becoming stronger.

The point here is that the Federal Reserve will have to dramatically raise interest rates later this year or we will suffer 3rd world inflation. The 10 year treasury rate will increase in tandem and 30 year fixed rate loan rates will be several percentage points higher than now. This in turn will cause house prices to continue to fall further. This happened in 1980 and interest rates were at 18% for a 30 year fixed loan. For example a $100K loan at 18% interest is $1500!!

Unless employers raise salaries to compensate for the higher cost of living, food and gas, (which I don’t see happening) house prices will continue to collapse. I believe the Fed is temporarily lowering interest rates to give people a chance to refinance and then the window will close later this year.

My SO and I are working professionals and still find it next to impossible to comfortably afford a mortgage. This is after accounting for a 20% down payment on a modest SFR.

Fortunately, prices have come down in Arcadia and another 25-30% drop does not seem unreasonable since homes doubled and nearly tripled in value during the peak of the bubble.

I think you’ve pointed out the biggest problem with this housing bubble. Salaries did not increase significantly during the last 4-5 years so there was no fundamental reason for housing prices to increase. It was all speculation. Be it Irvine, Los Angeles, Orange County and yes, even Arcadia, there was no “income bubble” to support the housing bubble.

Interest rates will have to go up eventually and as you said, there is no where for home prices to go than down.