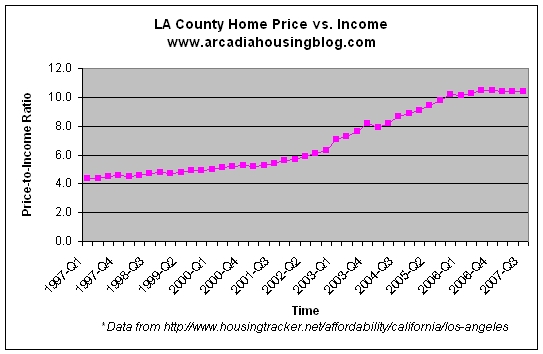

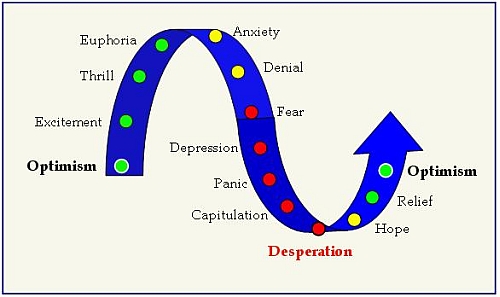

A financial bubble can be defined as the inflated, over-valued state of a market by unsustainable means. It is important to distinguish between what an asset is worth compared to its fundamental value.

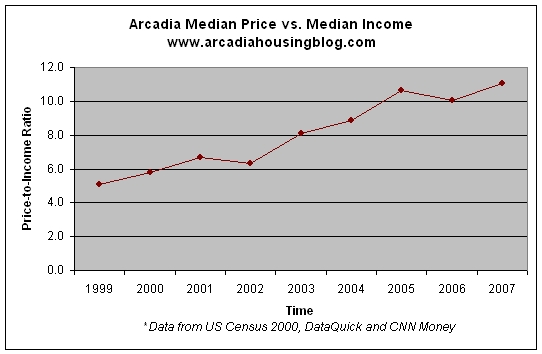

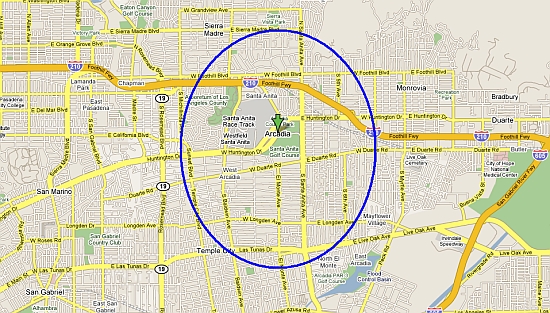

A house is worth what a buyer is willing to pay for it. During the past few years, a typical single family home in Arcadia could be worth $1MM because people were willing to pay that dollar amount. On the other hand, its value is determined by its intrinsic offering – whether that is the shelter it provides or the cash flow it can generate. When I say “market fundamentals,” I am referring to the factors that contribute to its value, not worth.

It is important to define and understand market fundamentals because it helps illustrate the state of the market and how far away are we from the stable, historical trend. In this post we will take a deeper look at three big factors that are tied to proven fundamental values:

-

Comparable Rents

-

Income

-

Supply & Demand

Comparable Rents

Comparable rents are directly related to market fundamentals because it gives a baseline measurement of the value and worth of a property. Whether you rent or own your house, you have a place to live – that is its worth. Its value comes from how the rent and home prices are tied. If you are an investor, you have to rent it for more than it costs you to own it on a month to month basis.

After all, it makes no financial sense to purchase a home when you can rent it for a fraction of the cost, giving the renter a chance to invest the extra money in another financial market at a higher yield. Then again, most people buy property based on emotional, not financial justification. Contrary to popular belief stemming from the lies of the National Association of Realtors, real estate is generally a poor investment in terms of rate of return. We will have to discuss this another time.

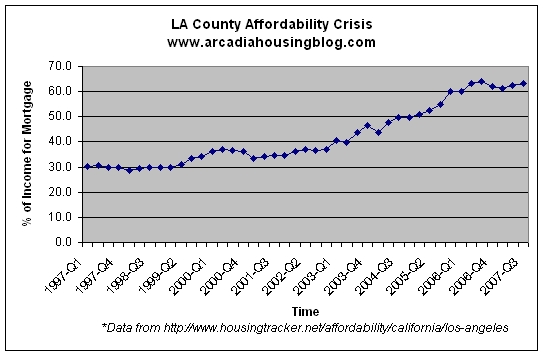

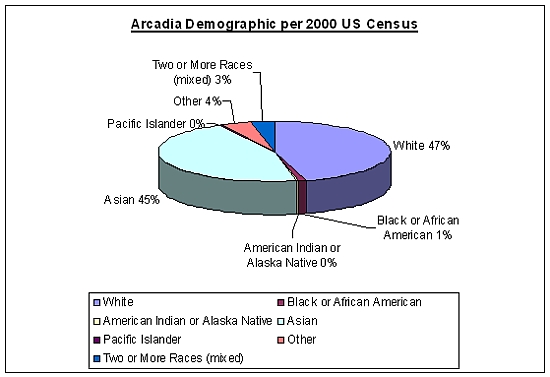

Income

Incomes are directly tied to rents. That’s a fact. Why? Because most people pay rent with their salary/wages. Last I checked, there aren’t too many folks born with a golden spoon and just live life off daddy’s payroll. On top of that, have you ever heard of anyone applying for a $500,000 loan at the bank to pay rent? No. Rents are paid with after-tax, net, disposable income.

In my opinion, this is the single most important factor in market fundamentals. It’s at the very core of how much house one can afford to rent or buy. Interest rates are also important, but are secondary players since you don’t need a loan to rent a place.

Supply & Demand

As home prices go up and people realize that it’s cheaper to rent than to buy, the pool of buyers dwindle and supply of homes move up. When home prices drop back in line with the rental rates of comparable properties, the scale shifts and an increase in buyers join the market to absorb the supply of homes for sale. It’s basic supply and demand.

We can analyze it until we all turn blue in the face, but it all boils down to where to put the money. Spend it on an depreciating asset and strap yourself to the house because you can’t afford to do anything else? Or rent a comparable place for much less, invest the difference and add to the future-home-down-payment piggy bank? I think you know where I stand.

Arcadia home prices are falling and will continue to drop until it reaches its market fundamental value. This will take years.