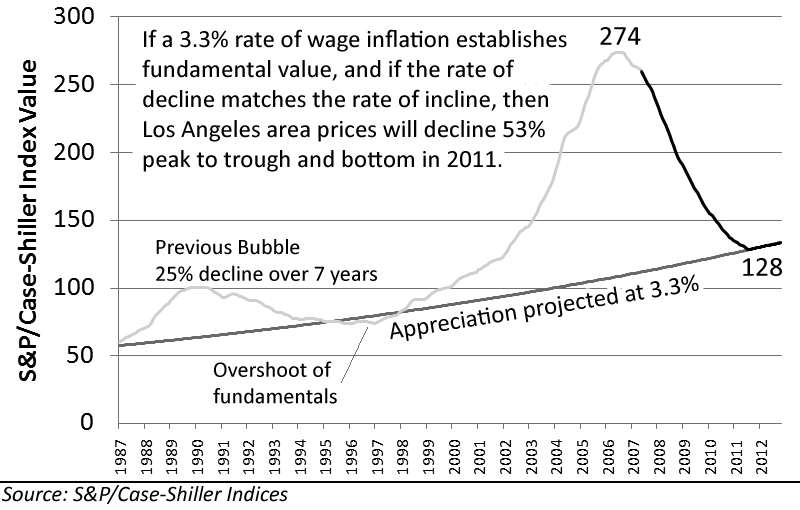

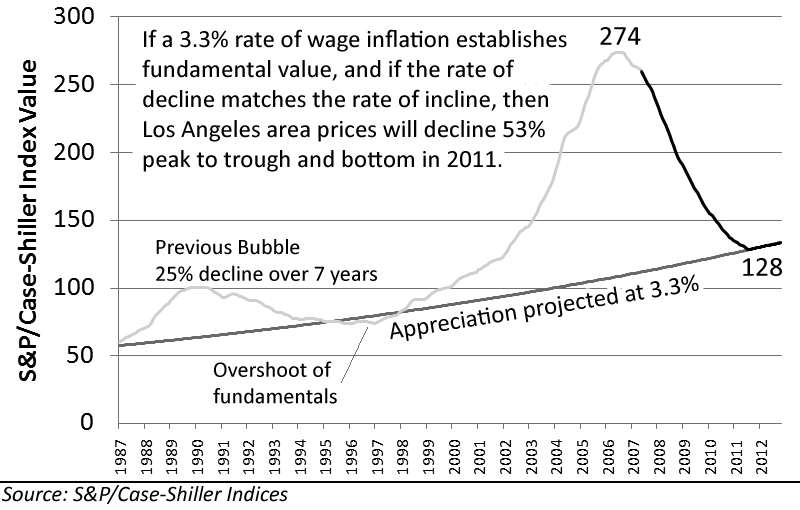

Most people give me a crazed look when I tell them home prices in Arcadia will drop another 25-30% over the next 3 years. Why is that so hard to believe when values doubled and nearly tripled over the course of 4 years? A housing bubble consists of 3 points: a peak and two bottoms.

Have we hit the second bottom yet?

Over the course of this housing downturn, I’ve personally met friends and associates who are all at different stages of the home buying process:

1) Renter Savers

These people may or may not have money for a downpayment. They understand how bad the market is and rent because it’s cheaper. This group of renters are living below their means and save a good portion of their monthly income.

2) The Clueless

These guys have very little money and absolutely clueless regarding what it takes to buy a home. Therefore, they rent and have no idea as to how bad this housing crisis is because it seemingly doesn’t affect them.

3) Would-be Knife Catchers

I am most worried about this group of friends. They are just starting to realize how much money homeowners made off real estate over the last 5 years and are eager to jump into the market. They view real estate as a great investment and renting as a “waste of money”. Many of them are excited over all the REO auctions popping up throughout Southern California and are eager to land a smashing deal.

In addition, these individuals all seem to know a Realtor or prominent financial guru who encourages them to buy now because we’ve hit bottom. I tell them we have a few more years of double digit price reductions to go and they shrug me off.

For those in Group 1, they’re in a good position. After this whole crisis blows over, those with cash-on-hand will have no shortage of affordable homes to choose from. Even if interest rates skyrocket, home prices will fall even further and a sizable downpayment increases your buying power.

For Group 2 folks, I’ll sum up the housing bubble in 7 points:

Late 1990’s – The tech boom crashes and everyone wants a safe investment: Real estate!

2000 thru 2003 – Fed lowers interest rates and increases home buying.

2003 – Sales weaken so lenders push for more interest-only (IO) and adjustable rate mortgages (ARMs).

2003 thru 2005 – Housing prices double and nearly triple throughout the country. East and West coasts become investment flipping hot spots and we get:

- Media hype

- A buying frenzy

- Investors flood the market

- Developers overbuild

- …and 1 out of ever 4 adults becomes a real estate agent. [sarcasm]

2005 thru 2006 – Mainstream media acknowledges that we’re in a “bubble” but the Feds, Wall Street and National Association of Realtors is resistant to the news.

2007 – Show’s over as the secondary lending market collapses overnight and eventually giants like Countrywide, Washington Mutual and Citibank get hammered. Sales volume and prices begin dropping at record levels.

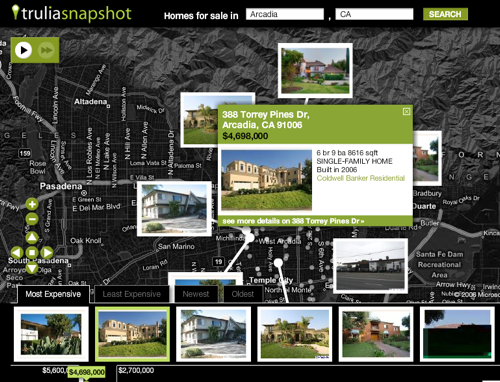

2008 – We see no stabilization in prices and definitely no bottom in site. The crisis makes it way into Los Angeles and all but a handful of cities show resistance to the trend. Sorry, Arcadia isn’t one of them.

Property and foreclosure numbers obtained from U.S. Census,

Property and foreclosure numbers obtained from U.S. Census,