| Asking Price | $599,000 | ::: | Sq-ft | 1,688 |

| Purchased Price | $586,000 | ::: | Lot Size | 7,410 sq-ft |

| Purchased Date | 12/24/2007 | ::: | Beds | 3 |

| Days on Redfin | 41 | ::: | Baths | 2.5 |

| $/Sq-ft | $355 | ::: | Year Built | 1941 |

| 20% Downpayment | $119,800 | ::: | Area | 210 fwy |

| Income Required | $149,750/yr | ::: | Type | SFR |

| Est. Payment* | $3,029/month | ::: | MLS# | A08044213 |

*Estimated monthly payment assume 20% down, 30-yr fixed @ 6.50%

“Price Reduced !! Priced for quick sale. one story single family residence with swimming pool, located in a nice neighborhood, north of Colorado. 3 Bedroom plus a den. Property has been completely renvoated in 2007, including newer kitchen with granite counter tops, newer appliances, newer bathrooms, double pane windows, newer garage door with remote. Formal dining room , Separate family room with marble flooring and access to the big covered patio. large size pool. spacious storage room next to the 2 car detached garage. gated driveway. property is zoned for R-3. property to be sold in ‘AS IS’ condition.”

I hate reading the descriptions most realtors put on the Redfin sales page. A $29,000 price reduction is hardly anything to get excited about and I never understand real estate talk on “newer” this and newer that. Newer than what? The 1970s hardware that was there before it? How new is newer? Also, it’s amazing what realtors are willing to say to get a sale. This property is literally right next to the 210 freeway and within a stone’s throw of all the noise and smog that will drive anyone batty. It’s obviously not “in a nice neighborhood.” Oh and by the way, it’s another REO.

Undesirable properties like this are often the first to show signs of weakness in a tough real estate market. Although we’ve documented some other REOs in more desirable locations, most of the pressure so far has been on condos, townhomes, SFRs by the freeway and those along the city’s border. While homes in the premier locations are experiencing softness with some price reductions and sitting longer time on the market, they have yet to see the heavy pressure I’m anticipating for later this year.

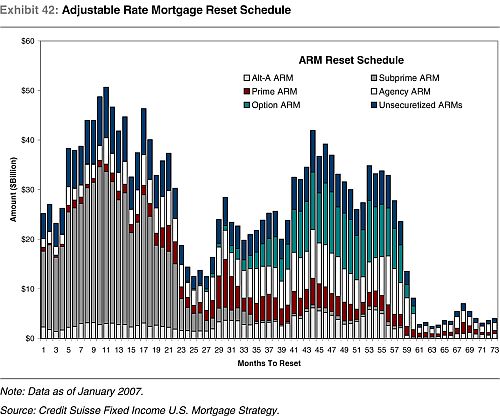

What’s taking so long? The system. We are currently on number 17 of the famed Credit Suisse ARM Reset chart below, but are barely experiencing the price pressures of re-listed REOs that defaulted 9 months to a year ago. Consider this – notice of defaults from loans that reseted on number 5 through 8 on the chart are just beginning to show up on the market. It takes a while for these homes to work itself through the system so I’m not surprised there aren’t more REOs at this point in time. It’s going to be an ugly Fall and Winter season this year. Unfortunately (or fortunately – depending on how you look at it), 2009 won’t be any better.

As for today’s profile, $599k for this real-estate-owned dump next to the freeway is a complete joke. Holy freeway noise Batman, you’d have to pay me to live there. Thanks, but no thanks.