When I was younger (and dumber) I used to think that renting was for poorer folks. My parents hammered into me the belief that renting was equivalent to throwing money away every month. Fortunately, college taught me that it was necessary to challenge everything I’ve learned as a child and realize that many things in life aren’t black and white. Can renting be a waste of money? Yes, but it doesn’t mean that’s always the case.

Putting the current inflated prices aside for a moment, let’s take a look at 4 reasons why MSN Real Estate says you should consider renting:

1. Renting can save money

At the very minimum you’ll be shelling out PITI for your home. That is:

- Principal

- Interest

- Tax

- Insurance

That doesn’t include property maintenance like upkeeping the yard, paint, plumbing, ect… When you rent, most people just make one monthly payment and that’s it.

2. Homeowners’ tax deductions are overstated

According to research quoted by MSN, “… half of homeowners don’t get a break, because even with mortgage interest and property taxes, their total deductions do not exceed the standard federal tax deduction ($10,900 for couples and $5,450 for singles)”.

For these folks, it’s like spending $100 to save $20. They’re better off saving the difference and investing it.

3. More options are available to renters

This is a no-brainer. Renters have a limitless supply of apartments, condos and empty homes to choose from. Even for a larger family it is possible to rent cheaper than it is to own.

4. Renting gives you flexibility

This point is dependent on your current situation. For the up and coming young professional, you’re better off renting and saving for a few years than to buy a small condo. Who knows how fast you will outgrow it?

Depending on how much you can save, families with children may be better off settling now since moving is a hassle.

My #5 reason why you should rent right now?

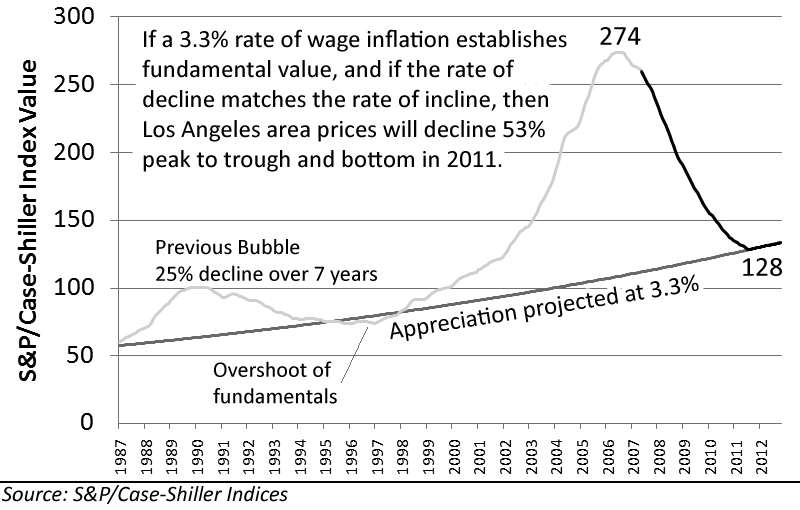

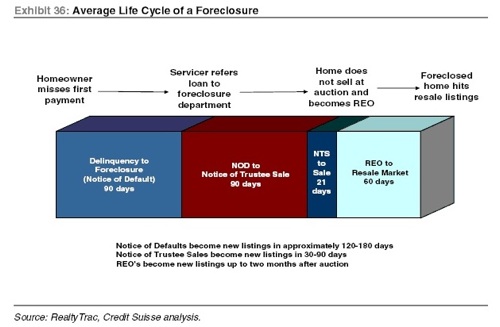

Property prices are declining, foreclosures are picking up and even with a sizable down payment, renting is still cheaper that owning. Don’t worry, you’re not going to miss the bottom because unlike stocks, real estate takes years to go anywhere. The bottom will be 2-3 years of flat prices and even investors will be crying doom and gloom.

That is when you know it’s time to buy.

Property and foreclosure numbers obtained from U.S. Census,

Property and foreclosure numbers obtained from U.S. Census,