Real estate always goes up.

Land is running out.

Rich foreigners are pouring in by the boat load.

Real estate is a great investment.

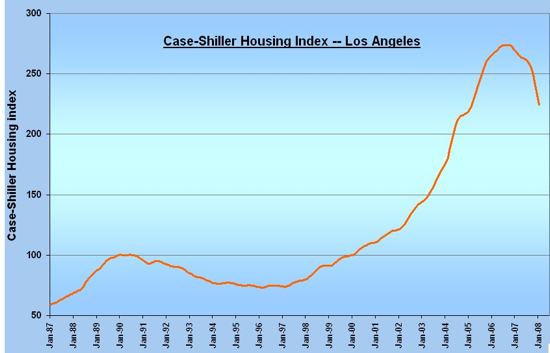

So why in the world are we facing the largest housing and credit crisis in U.S. history?

The Culprits

Lenders started pushing sub-prime loans so people with bad credit and no down payment could afford to buy homes. Lenders such as Countrywide even scammed prime borrowers into taking out sub-prime loans. Why? Because back-end commissions were higher and Wall Street eagerly paid for these risky loans.

Artificial demand was created when otherwise unqualified borrowers began buying up houses left and right. There was no significant growth in income or even population. Million dollar homes were bought up by people making less than $100k a year on zero down, interest only, adjustable rate mortgages.

Wall Street somehow decided it was a good idea to securitized these sub-prime loans and sell them on the open market.

Builders decided to increase their home production even though there was no marketing data supporting the need for a significant increase in housing.

The Outcome

Greed – Greed – Greed. That’s what this housing bubble comes down to.

- Lender such as Countrywide and New Century are wiped out.

- Homeowners are losing their homes through rapidly increasing foreclosures.

- Wall Street giants such as Bear Stearns, Citi and WAMU are in major distress.

- Public builders such as KB Homes, Lennar and Centex are in a financial mess. Local builders are shutting down left and right.

Feel free to share this post with friends, family and coworkers the next time they ask, “So what got us into this mess?”