This is brand new construction that was completed in 2007 by an investor who was obviously looking to make some money. It’s a typical McMansion home complete with the ugly 1990s peachy, pink exterior wall color. The interior is actually quite nice with the open layout, big windows and tray ceilings. Unfortunately for this seller, those features won’t be enough to bring in the $2.78MM asking price. I saw this property on Redfin about 4 weeks ago, but it’s posted as a new listing so the realtor took the listing off and re-listed it to reset the days-on-market counter. It’s probably been sitting on the market for quite some time.

| Asking Price | $2,780,000 | ::: | Sq-ft | 5733 |

| Purchased Price | $1,100,000 | ::: | Lot Size | 0.49 acres |

| Purchased Date | 9/28/2005 | ::: | Beds | 6 |

| Days on Redfin | 1 | ::: | Baths | 7 |

| $/Sq-ft | $484 | ::: | Year Built | 2007 |

| 20% Downpayment | $556,000 | ::: | Area | Santa Anita |

| Annual Income Required | $695,000 | ::: | Type | SFR |

| Est. Payment* | $14057/month | ::: | MLS# | A08010983 |

*Estimated monthly payment assume 20% down, 30-yr fixed @ 6.50%

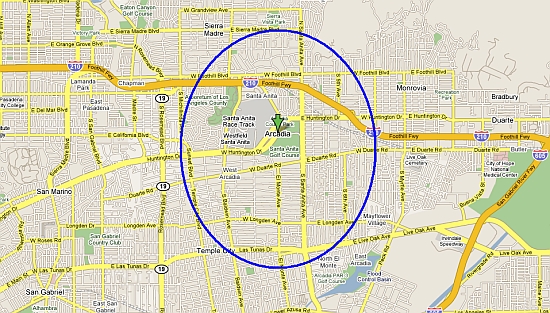

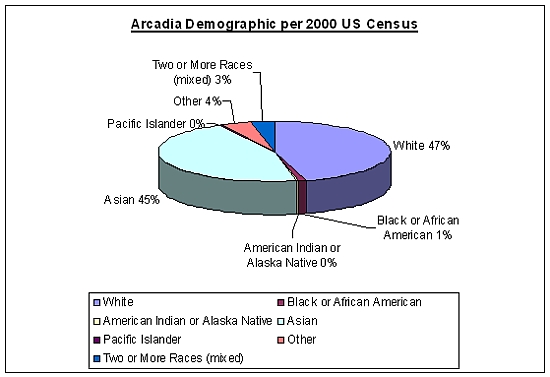

I think this seller drank so much kool-aid during the boom that both he and his realtor are now completely separated from reality. This is suburbia town Arcadia – not Newport Beach, Brentwood or Beverly Hills. My guess is someone making $695k annual income who can afford over $14,000/month mortgage payments won’t chose to live in Arcadia. I for one would prefer a home in Newport so I can wake up to the Pacific Ocean. Even if a buyer preferred a suburbia community in the San Gabriel Valley, they would certainly choose San Marino over Arcadia.

Anyways, I didn’t post this listing only because its overpriced. The main thing I wanted to share with you is this property’s previous sale history. According to Redfin, this particular seller bought in 2005 for $1.1MM, but what’s more interesting are the five transactions before that.

| Date | Price | Appreciation |

| 9/28/2005 | $1,100,000 | 16.4%/yr |

| 9/10/2001 | $595,000 | >1000%/yr |

| 8/15/2001 | $325,000 | -21.3% |

| 1/19/1999 | $602,000 | -5.2%/yr |

| 1/08/1993 | $830,000 | -1.5%/yr |

| 1/02/1992 | $842,727 | — |

As you can see, the previous house that stood on this property sold for $842,727 in 1992 during the initial decline of the previous bubble (which peaked around 1990). Over the next 9 years, it’s price reductions take off in a logarithmic fashion starting with -1.5%/yr between 1992 and 1993. Over the next 6 years, it would lose a 5.2% each year before coming to a sale in 1999 at $602k. From there, the market continues to plummet a whopping -21.3%/yr over the next 2.5 years to rock bottom in 2001. That makes a total decline of $517,727 or 61% off from peak to bottom.

OUCH.

But I thought real estate is always goes up and everyone wants to live in sunny southern California so prices would never drop here. What happened? Market correction happened. This is a wake up call for the sheeple to stop drinking the kool aid and face the facts. Arcadia home prices will fall and contrary to what the realtors say, it is not immune to the current market conditions. It wasn’t last time and it won’t be this time either.

:: SavedByGrace